With seven little words, Fed Chair Powell unleashed some chaos today as he confirmed "time has come for policy to adjust" and rate-cut expectations adjusted dovishly (though we note they were pretty much fully priced for this after the Minutes).

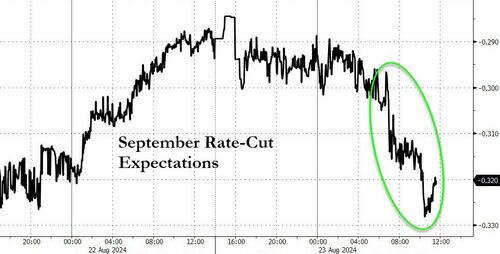

September rate-cut expectations rose to 32bps (so around a 1/3rd chance of 50bps, 2/3 chance of 25bps)...

Source: Bloomberg

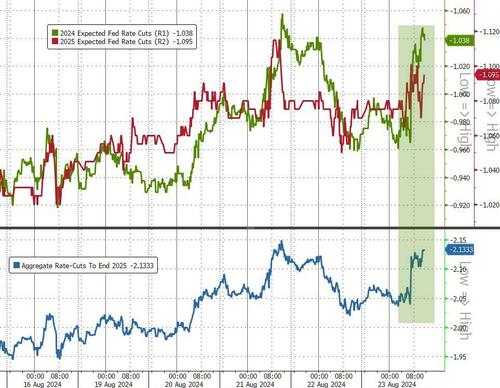

2024 rate-cut expectations lifted to 104bps (just over 4 full cuts - well above the single-cut according to The Fed's Dot-Plot) and 213bps thru the end of 2025...

Source: Bloomberg

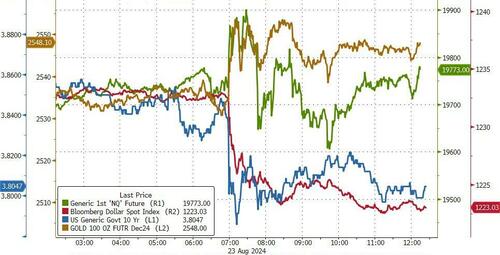

Gold, bonds, and stocks rallied while the dollar tumbled...

Source: Bloomberg

The instant bid in stocks only really held in Small Caps...

...thanks to a huge short-squeeze...

Source: Bloomberg

The dollar crashed to 2024 lows...

Source: Bloomberg

Treasury yields tumbled, led by the short-end today (2Y -10bps, 30Y -2bps) and down 14bps on the week...

Source: Bloomberg

The 2Y yield snapped back below 4.00% and the curve (2s30s) pushed notably steeper...

Source: Bloomberg

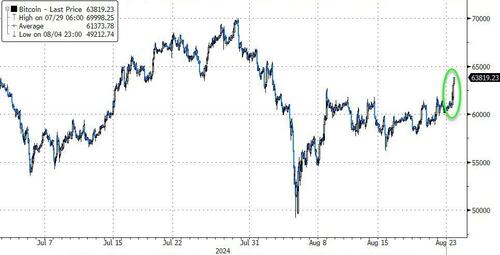

Bitcoin blasted off on the Powell headlines, setting the scene for the big short-squeeze we have discussed and testing $64,000...

Source: Bloomberg

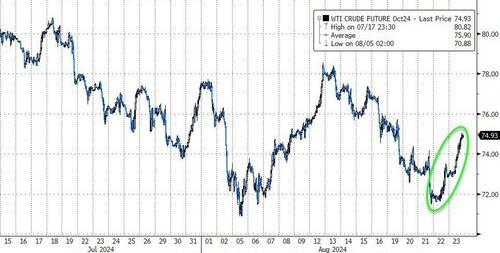

Crude oil prices also surged, bouncing further off those early August lows...

Source: Bloomberg

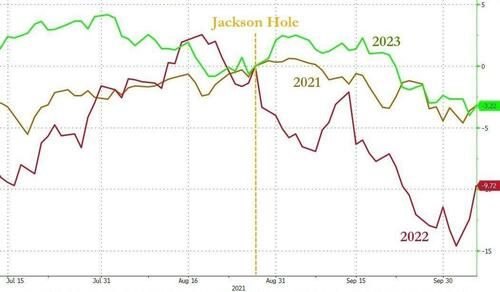

Finally, we note that five of the six Powell Jackson Hole speeches saw the S&P 500 drop 7.5% on average in the next three months...

Source: Bloomberg

...and The Fed will begin cutting rates with the MSCI All-World Stocks Index at an all-time record high!!!

So brace!

With seven little words, Fed Chair Powell unleashed some chaos today as he confirmed "time has come for policy to adjust" and rate-cut expectations adjusted dovishly (though we note they were pretty much fully priced for this after the Minutes).

September rate-cut expectations rose to 32bps (so around a 1/3rd chance of 50bps, 2/3 chance of 25bps)...

Source: Bloomberg

2024 rate-cut expectations lifted to 104bps (just over 4 full cuts - well above the single-cut according to The Fed's Dot-Plot) and 213bps thru the end of 2025...

Source: Bloomberg

Gold, bonds, and stocks rallied while the dollar tumbled...

Source: Bloomberg

The instant bid in stocks only really held in Small Caps...

...thanks to a huge short-squeeze...

Source: Bloomberg

The dollar crashed to 2024 lows...

Source: Bloomberg

Treasury yields tumbled, led by the short-end today (2Y -10bps, 30Y -2bps) and down 14bps on the week...

Source: Bloomberg

The 2Y yield snapped back below 4.00% and the curve (2s30s) pushed notably steeper...

Source: Bloomberg

Bitcoin blasted off on the Powell headlines, setting the scene for the big short-squeeze we have discussed and testing $64,000...

Source: Bloomberg

Crude oil prices also surged, bouncing further off those early August lows...

Source: Bloomberg

Finally, we note that five of the six Powell Jackson Hole speeches saw the S&P 500 drop 7.5% on average in the next three months...

Source: Bloomberg

...and The Fed will begin cutting rates with the MSCI All-World Stocks Index at an all-time record high!!!

So brace!